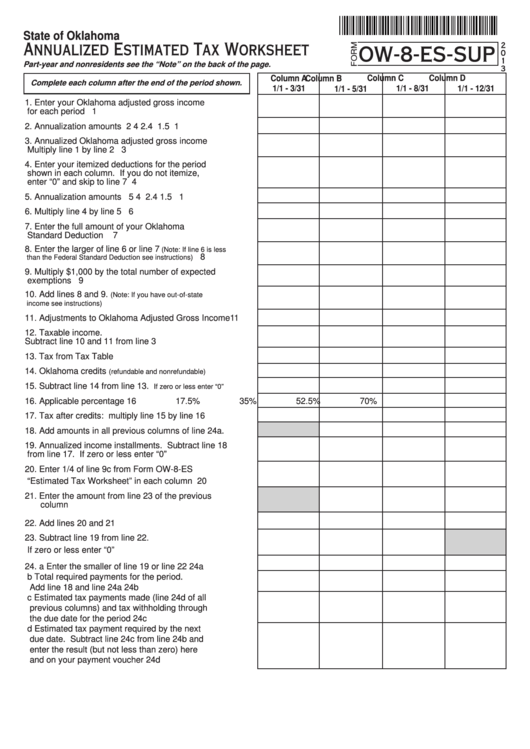

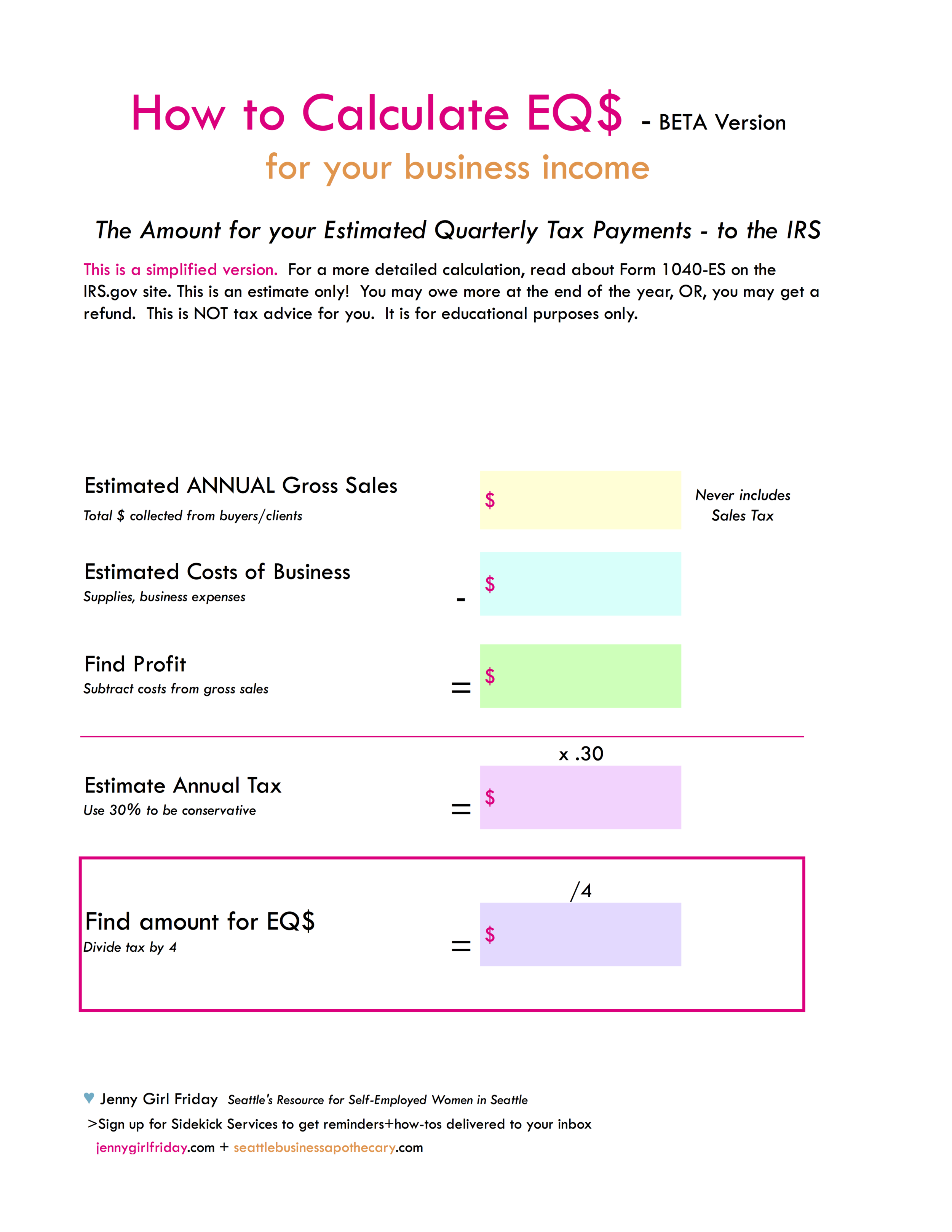

Irs Estimated Tax Payments 2025 Worksheet. By the end, you’ll feel more equipped to navigate estimated. Line 5 is where estimated credits are included.

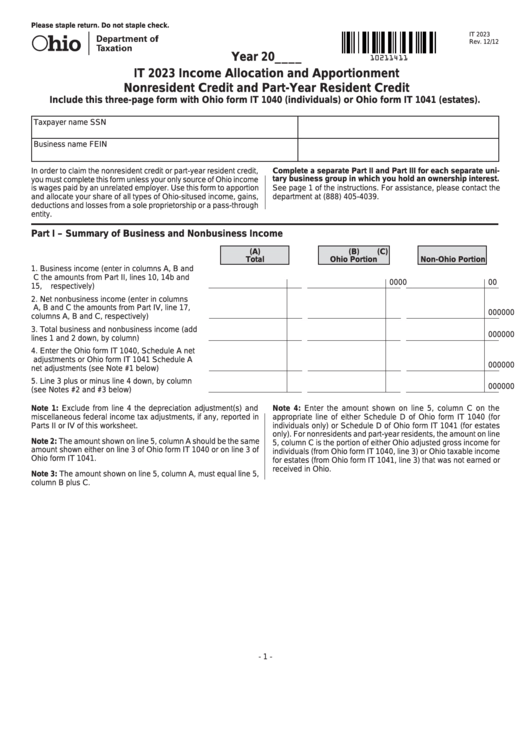

For the year 2025, the irs has provided guidelines and updates for estimated tax payments. Who may need to pay estimated taxes individuals, including sole proprietors, partners and s corporation shareholders, may need to make estimated tax payments if:.

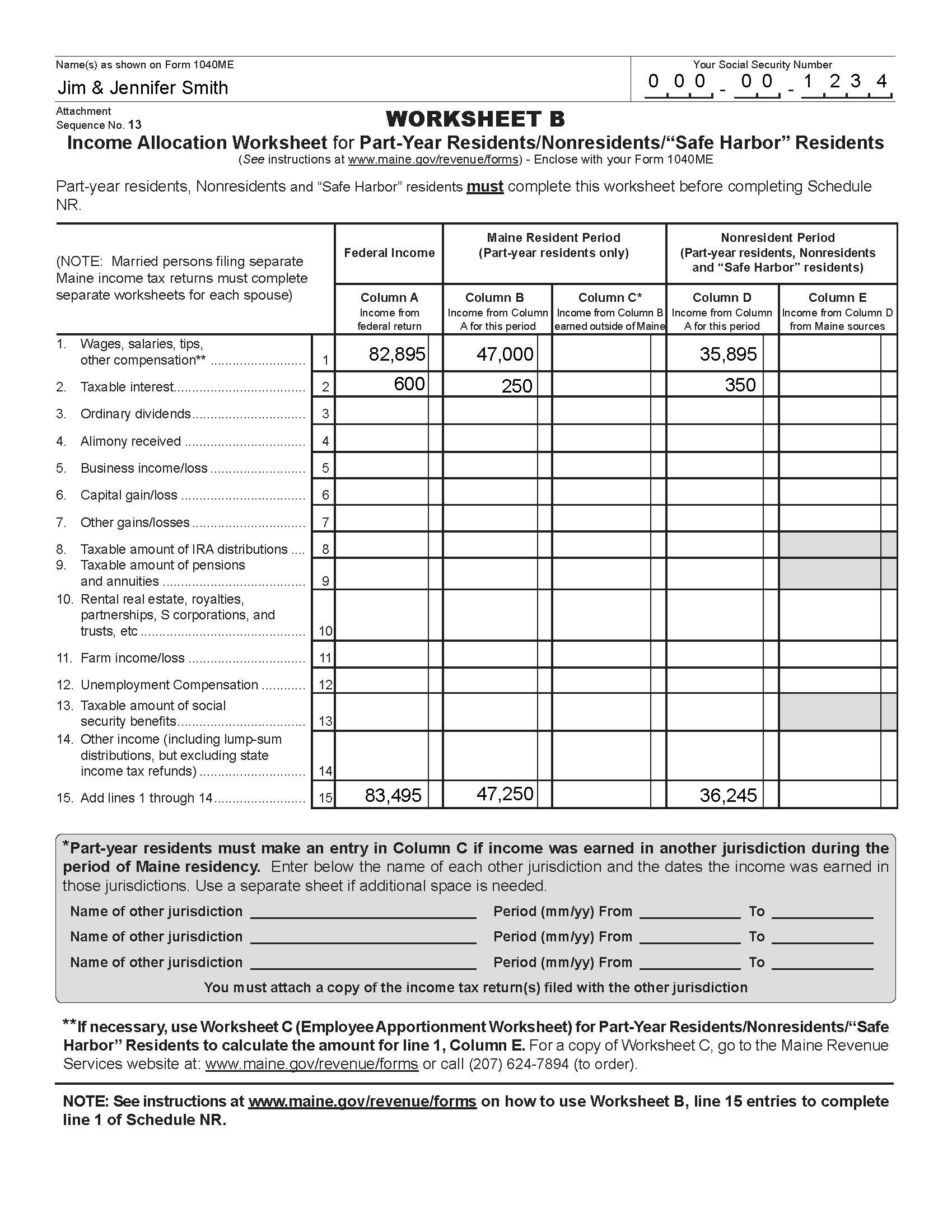

Irs Estimated Tax Payments 2025 Worksheet Rania Lethia, To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the.

Estimated Tax Worksheet 2025, This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

Irs Estimated Tax Payment Worksheet, For the year 2025, the irs has provided guidelines and updates for estimated tax payments.

Irs Estimated Tax Payment Form 2025 Deana Estella, A corporation must generally make estimated tax payments as it earns or receives income during its tax year.

Estimated Tax Payments Worksheet, 27, 2025 — the internal revenue service today encouraged taxpayers to consider using the end of the summer to make tax withholding or payment updates to.

Estimated Tax Payments 2025 Due Schedule Lanna Pietra, Who may need to pay estimated taxes individuals, including sole proprietors, partners and s corporation shareholders, may need to make estimated tax payments if:.

20222024 Form IRS 1120W Fill Online, Printable, Fillable, Blank, Irs estimated tax payments basics:

Estimated Tax Worksheet 2025, Use the estimated tax worksheet to calculate your estimated tax for the next tax year and set up the electronic withdrawal of estimated tax payments.

2025 Estimated Tax Payment Worksheet Abby Linnea, Sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps) enrollment required to use.